Fulham have signed a new sponsor, an opaque trading firm which “guarantees” 248% annual returns and has a complex, multi-tiered rewards scheme.

Last week, Titan Capital Markets were unveiled as Fulham’s “Official CFD Trading Partner”. I won’t beat around the bush: this company does not appear to be genuine to me and Fulham ought to be ashamed for having signed the deal without doing any due diligence. In essence, many of the headline claims that the company makes for itself simply cannot be true and Fulham have no excuse for failing to recognise this.

The numbers don’t add up

Almost everywhere you look, there are glaring issues with Titan. The company was incorporated in Australia on 28th March 2022 and launched its website on 31st March.

Yet on its website it displays the financial performance of its two trading teams, reporting extraordinary double-digit monthly returns from January to June.

The problem with this, of course, is that even if these returns are genuine and had been achieved by the named traders, they could not have happened at Titan Capital Markets as the company didn’t exist in January, February or (almost all of) March.

[Update: on 13th October, Titan deleted, without explanation, these returns charts from its website.]

So the best that can be said about the headline financial promises is that an error in the website population process led to false and materially misleading returns being displayed. But these returns aren’t real, of course. If they were, £100 invested in January with the “Fire Fox” trading team would have been worth £657.80 by the end of June. That is the equivalent of an annual return of 1,216%.

Even the more modest “guaranteed” monthly return of 14% annualises to 248%.

Thirty seconds’ thought ought to tell anyone – whether employed by the Fulham commercial department or not – that these returns are impossible to “guarantee” and that no reputable business would claim to be able to do so.

If a company could genuinely guarantee 248% annual returns, it would not be selling financial education packages and taking a commission on trades. It would be trading on its own account and rapidly turning itself into the largest investment management company in finance history.

[Update: on 13th October, Titan deleted, without explanation, the graphics displaying a guaranteed return of 14% from its website.]

Vexillologists assemble

Really that ought to be the end of it; the firm just cannot be what it claims to be. But what makes things worse for Fulham is that everywhere you look, there are more and more red flags.

The firm’s supposed area of operation – Contracts For Difference (CFDs), which allow traders to, in effect, make leveraged bets on the future prices of assets – are heavily regulated in the UK. Any firm offering CFDs is constrained in how the product is structured and sold. Titan, however, doesn’t even include a basic risk warning on its website.

[Update: on 13th October, Titan added, without explanation, a risk warning to its website footer. The warning seems to me, however, to be still inadequate when compared to UK FCA regulations on offering CFDs. It was also stolen word-for-word from another almost equally dubious-looking forex trading website.]

The company is licensed in Australia and claims to be so in Canada, presumably through a related company, Titan Global Capital Markets Ltd. Both of these companies are solely owned by a man called Klaus Huber, about whom more shortly. (There was also a British company called Titan Capital Markets, which went under in 2017 and whose presence continues to haunt some social channels, but there doesn’t seem to be any connection to Fulham’s new partners.)

Mysteriously for a consumer-facing firm with almost zero digital footprint – no signposted Facebook, no Twitter, no Insta – Titan has an active Telegram channel where it advertises its wares at Zoom seminars. As if it weren’t odd enough for a CFD trading firm to recruit through Telegram, which is the preferred channel of crypto scammers, these seminars kick-off at 02.00 on Australia’s east coast. The adverts also display the start times in numerous African and South East Asian counties, all of them a great deal more convenient than a 2am alarm call in Canberra.

In other words, an Australian financial services firm is primarily recruiting in developing nations where it’s not regulated. Indeed, it appears to have a satellite office in Vietnam already.

And it has also run an in-person recruiting seminar in Ghana, where a local pastor preached to a group of recruits, all dressed in Titan-branded t-shirts, about how Titan would, “show them the light” and the way to “financial freedom.” (Elsewhere, there are videos of Titan events in Thailand, China, Togo and Cameroon.)

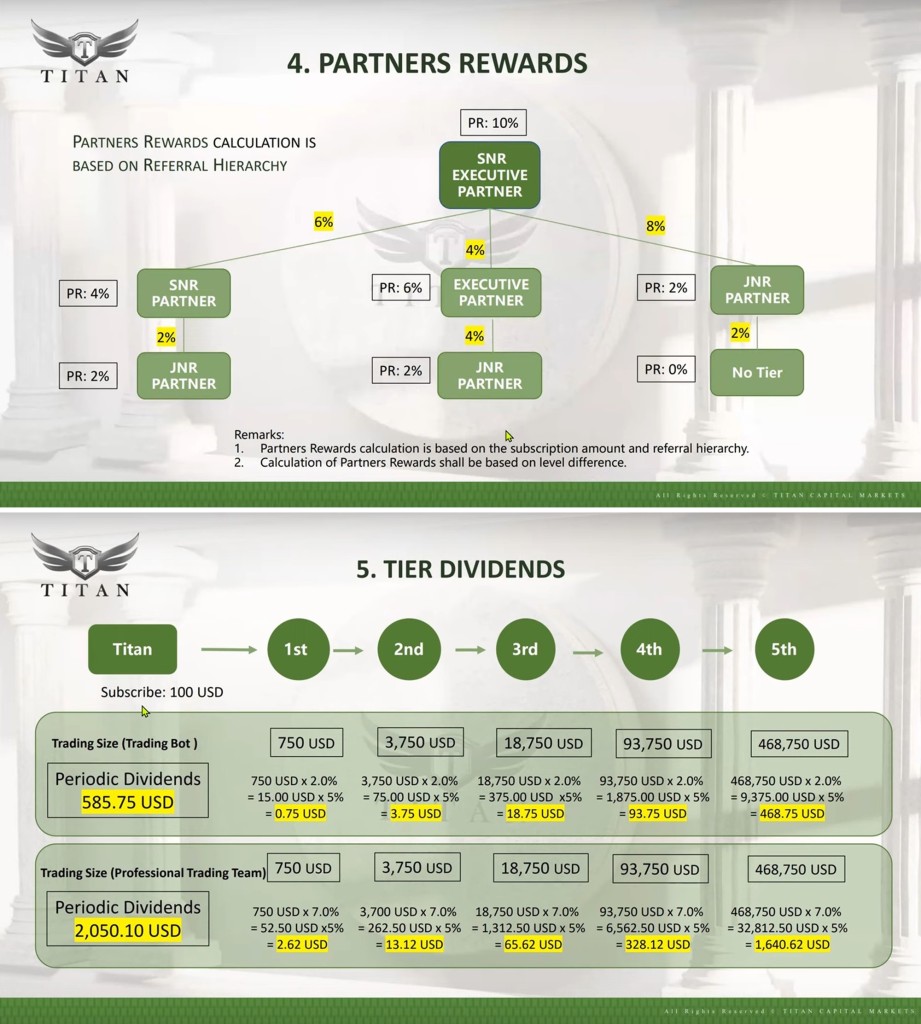

All of this finally makes sense when you actually sit through a Titan presentation. Rather than being a trading firm, it appears instead to be a multi-level marketing firm (MLM), which charges for membership and distributes rewards based on numbers recruited and trading performance in a range of tiers.

Now, depending on the degree to which a firm operating like this sells genuine products or services – or simply runs on recruitment commissions – it is either a multi-level marketing firm or a pyramid scheme. Either way, the presentation repeated the misleading and impossible “guaranteed” returns (here showing 7% guaranteed each 15-day period; 14% a month).

If impossible returns and a complex, many-tiered rewards scheme are being used to recruit people in developing nations on the promise of financial freedom, then pyramid scheme or not, it is at the very least an ethically questionable company, acting, it seems to me, in a misleading and predatory way.

For bonus points, the “how to deposit” tutorial appears to suggest that investors must do so using Tethers, a so-called “stablecoin” – a cryptocurrency designed to maintain parity with the US dollar to facilitate crypto trading. I asked Titan why crypto was part of the scheme and if people could invest in standard fiat currency, but did not hear back from them.

On its website, the firm proudly displays a trophy on for “Best Innovative Forex Broker” at the WikiFi Awards. In fact, the awards, which took place in September at a WikiFi conference in Dubai, resulted in Titan receiving the “Most Trusted Algorithmic Trading Platform” award. How a company which, at that point, had been trading for less than six months could qualify for either award baffled me until I found that Titan was a “global sponsor” (the highest tier) of the conference. I contacted WikiFi for an explanation of which award, if any, Titan had won and for a breakdown of the judging process and criteria, but have not yet heard back.

Who are ya?

The CEO of Titan is a man called Howard Yan, who proudly likes to claim the words of Isaac Newton as his own.

He does appear to be a real person, in as much as his old website is still online, where he advertises trading seminars. The website is very light on verifiable biographical detail, however. And when I say “old”, I mean populated with articles and testimonials purporting to be from 2020 and 2021. The site itself was actually purchased and launched in June 2022, presumably as part of an attempt to give the public face of Titan a digital footprint that might fool the unwary. The content itself was plagiarised wholesale from the website of another forex trading guru.

[Update: on 13th October, Howard Yan’s website was taken down without explanation and then, on 14th, reinstated.]

Other senior staff have names that, while attached to living, talking bodies, are surprisingly difficult to link to any substantial digital footprints.

Intriguingly, one of the two lead traders, he of the 1,216% annual returns, does have a brief LinkedIn entry, which seems to suggest he’s been at six-month-old Titan Capital Markets… for over four years. The additional biographical and career information on his profile hasn’t been enough to enable me to tie it back to one individual, despite his relatively uncommon name. His company biog says that he has an MBA, which his LinkedIn claims was from the London Business School. I called them to verify this and they said that, “this individual has not studied, nor obtained a degree from LBS.”

There’s no saying these people are not necessarily real, just that it’s rather difficult – and unusually so in my experience – to find out what else they did before they joined Titan.

What I can say is that none of the people featured in the video from which these stills were taken, which is titled “Titan Capital Markets Board of Directors“, is shown as a director on the company’s filings at the Australian Securities and Investments Commission. This includes the CEO, Howard Yan, and the Executive Chairman, Klaus Huber. As I said earlier, Huber is the sole shareholder, leaving frontman Yan, the supposed founder and CEO, as neither a shareholder nor a director of the firm whose public face he is.

Elsewhere in the video, the company claims to have founded the “Cambridge Titan Institute” and the “Titan Research Laboratory”. Neither appear to exist.

In other words, almost everything Titan claims about itself – other than that there is an Australian company by that name – seems to be either obviously false or extremely difficult to verify.

When you combine this with its focus on recruiting affiliates in developing countries, its remuneration structure and its impossible “guaranteed” rates of return, it’s hard for me to conclude anything other than that Fulham’s newest corporate partner is not quite the financial services trading firm it presents itself as. There’s no suggestion of any criminality on Titan’s part, but, in my view, there’s evidence here that raises concerns that Titan’s structure is unlikely to deliver the riches it promises to people in developing countries.

Either way, it seems to me that Fulham have failed their fans – and potential Titan recruits – by signing this deal. Everything in this article was the product of just a few hours poking around; the basic due diligence that football clubs ought to be doing before they get anywhere near signing a contract. But, as I said earlier, just a few minutes on the Titan website should’ve been enough if the club were approaching it with a mindset that they have a duty to properly vet who they do business with.

And bad as this looks for Fulham, they aren’t the only ones. Deals like this are happening on such a scale that it demands coordinated action from football’s authorities or, if they won’t act, an Independent Regulator.

Something must change because, right now, the only guarantee in any of this is not 248% annual returns but that football clubs are going to continue to get themselves in trouble by taking the cheque first and asking questions later.

******************************************

I contacted both Fulham and Titan repeatedly with a wide range of questions about the deal, but did not hear back from them. As and when they get back to me, I will include their responses.

******************************************

Update: While Fulham and Titan still refuse to respond, on 13th October it appears that Titan began a sustained campaign to clear-up evidence of its activities, removing the most obviously problematic and deceptive claims from its website. It went on to geoblock its website from UK IP addresses, as well as those in the US and Australia. Howard Yan’s old website also vanished. What prompted these actions or where they will lead is unclear, but it is hard to regard them as evidence of a legitimate company with nothing to hide.

Update 2: Following an investigation by the Mail on Sunday on 6th November, which showed that almost all the senior staff in Titan collateral were actors or models – including the CTO, who it turns out is also a singer in a Malaysian punk band – Fulham finally pulled the plug on the Titan deal.

******************************************

Martin Calladine

If you enjoyed this piece, please buy my latest book: No Questions Asked: How football joined the crypto con. That way, I’ll have the money to write more things you might like. Oh, and please spread the word, too. Thanks a lot.

Pingback: Fulham terminate controversial partnership with Titan Capital Markets - ThePsp